- What is eBay's Product Research Tool?

- The Riches Live in the Long-Tail

- Higher Sell Through Rates = Hotter Selling Products

- Step #1: Choose a category

- Step #2: Open up the eBay Product Research tool in the Seller Hub

- Step #3: Start at the top of the funnel for insights (Market level behavior)

- Step #4 Drill Deeper into (product level behavior) using listing filters

- Let Customer Data Guide Your Strategy

Everyone who sells online has struggled with finding good products to sell. Choosing the right products is not an easy thing to do when you consider the millions of choices that exist.

If you add in limited budgets for buying inventory, all these choices can easily make the experience overwhelming.

But what if there was a way to cut through all the noise so you could buy items to sell that you know are winners?

Thankfully there is – It’s called eBay’s product research tool. In this guide, we will walk through everything you need to understand to help you use this powerful free research tool to find winning items you can sell on eBay.

What is eBay’s Product Research Tool?

First, let’s cover what the eBay product research tool (formerly Terapeak) is exactly. eBay offers sellers a free product research tool in the seller dashboard. It’s a pipeline into eBay’s trove of sales data sellers can use to gain insights into how products (and ultimately categories) are performing across the eBay marketplace.

Here are some of the big-ticket metrics the eBay product research tool provides to help evaluate products:

- The number of active and sold listings for specific items

- Average sales prices

- Item condition

- Sell-through rates

- Average shipping costs and the number of listings offering free shipping

- Seller and buyer locations

- Sales trends over time

- Unsold inventory

- Which listing formats sellers are using (Auction or Buy it Now)

Each of these metrics will help you build an overall category profile, so you know what is happening in the marketplace.

Aside from all the metrics data, another reason I like this product research tool is that it significantly reduces the need to use the manual method of estimating sell-through rates by using eBay’s sold listings filter in their search results. For busy resellers, this is a huge time saver.

The Riches Live in the Long-Tail

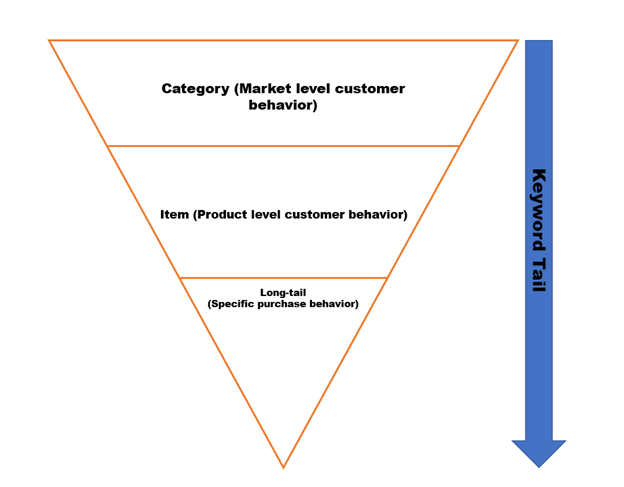

Now that we have an idea of what eBay’s product research tool is and how it can help us, let’s talk strategy. The best way to find the right products to sell is by having a method for drilling down on buyer behavior.

To do this, we can start our research at a very broad category level and work our way down using the long tail funnel method.

The idea here is, that if we drill down far enough, we will start to identify the specific products customers are buying and the keywords they are using to find them.

Higher Sell Through Rates = Hotter Selling Products

As we get more specific with keywords in our drilldowns, we should see the sell-through rates increase. This will tell us which items in a category are the winners and which ones are not driving a lot of action in the space.

A common question I see a lot of sellers ask is: What is good sell-through rate? The answer is it depends on the category. The sell-through rates in the auto category are completely different than what you would find in antiques or shoes. Each market has different drivers so what is considered low in one category may be rockstar status in another. When using Terapeak, I do generally try and target items that have a sell-through rate that is greater than 40%. Items in this range have a much greater chance of selling faster.

What I also look for is the sales price ranges, so I can understand the bottom, middle, and top of the market. It’s important to understand what buyers are paying so you can price your items just right. Now, let’s go through the steps so we can see Terapeak in action.

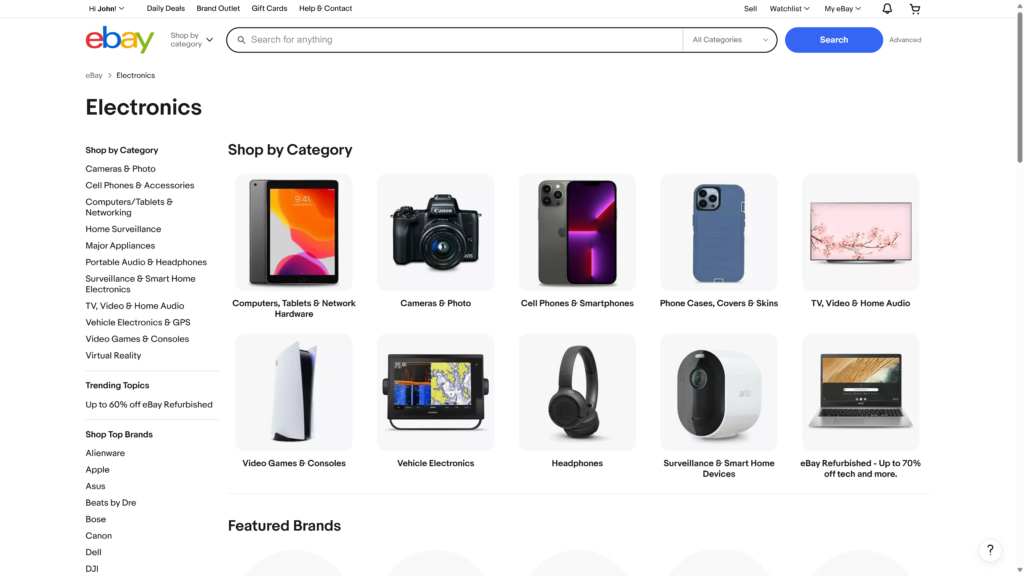

Step #1: Choose a category

I’m going to use the electronics category for this guide. You can pick any category you like as the process is the same for all of them. We start by heading over to eBay’s home page and selecting the electronics category.

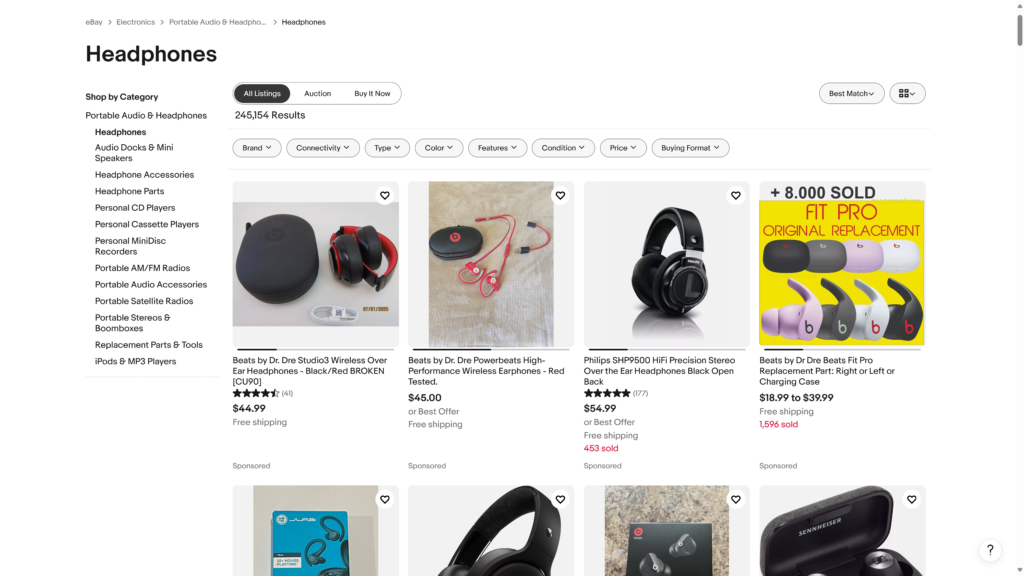

Pretty easy so far. If we scroll down a bit, we can see the breakout of the electronics category into the sub-categories (or buckets as I call them) and there are 10 to choose from. This is where you want to start your drill down. Let’s pick headphones and look at the active listings.

Brand, Connectivity, Type, Color, Features, and price are all important factors buyers look for when deciding which headphones to buy. eBay conveniently breaks these out as filters buyers can use to search for the features they want. We are going to use them as the basis for our product research as you will see later in the guide.

The price range for headphones based on the filter above is broken out into 3 buckets:

- Under $30

- $30 to $70

- Above $70

This is the information I want to know early on about the bottom, middle, and top of the headphone market. This already gives me an idea of what buyers are willing to spend on headphones. This will come in handy later as we look at the sell-through rates of each range to figure out which range has the most opportunity.

Step #2: Open up the eBay Product Research tool in the Seller Hub

The product research tool lives in eBay’s seller hub under the research tab.

When you first open it, you are greeted by a search bar and a few dropdown selections. The main search bar is where you enter information for products you want to research.

Next to the search bar, you can set the date ranges you want for your research. You can view activity in the last 7 days all the way up to the last year. 90 days is usually the best choice for a default to give you a wide enough view of overall activity in the market.

You also have the option to change the listing site to review data from eBay’s other sites if you sell internationally, but for this walkthrough, we are going to use ebay.com

Step #3: Start at the top of the funnel for insights (Market level behavior)

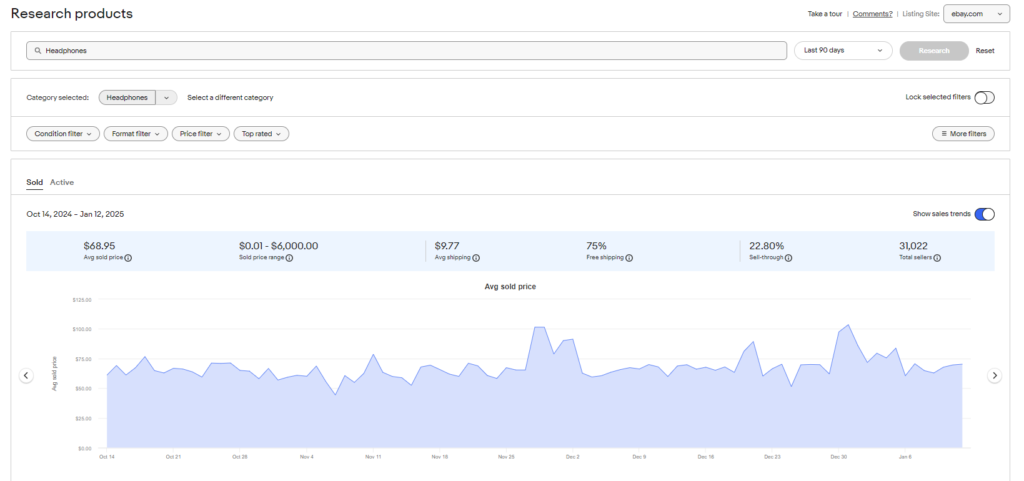

If we start at the category level with no filters, we can see an overall broad picture of headphones market activity in the last three months. The average sold price is $68.95, which is in line with the three buckets we found in our listing results.

Some other things to note are that 75% of sellers are offering buyers free shipping That’s 3 out of every 4.

The overall sell-through rate for all headphones is about 22.8%. What makes this useful is we can use the 22.8% as a baseline for drilling down deeper. If there are products that fall below 22.8%, we may not want to source those to sell as they are moving slowly. Items above 22.8% are a better choice to source and sell as they have more buyer action. Let’s look at some of the different charts eBay’s listing tool offers.

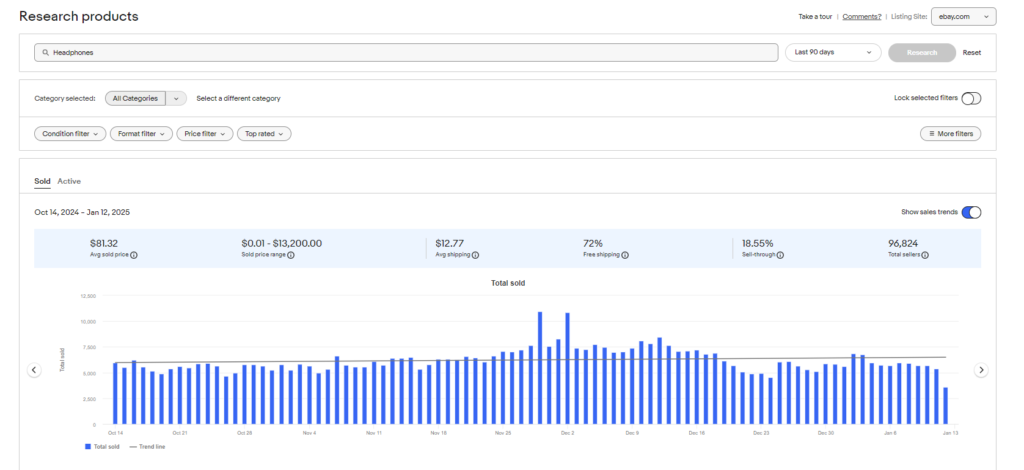

Total sold is the next chart we can review. This is helpful as it tells us what kinds of sales activity trends are happening in the marketplace. In the last three months, headphones overall have seen an upward trend in sales. What this data also tells us is if we hover over the bars in the chart, we will see specific days along with the total sold.

There are two standout days in this data with the highest sales: Black Friday and Cyber Monday. That’s not too surprising since those are huge shopping days! But beyond those, you can dig into the daily data to spot other patterns. Are certain days of the week busier? Do sales pick up at the beginning or end of the month? These insights can be super helpful when planning your social media marketing strategy to make the most of those trends.

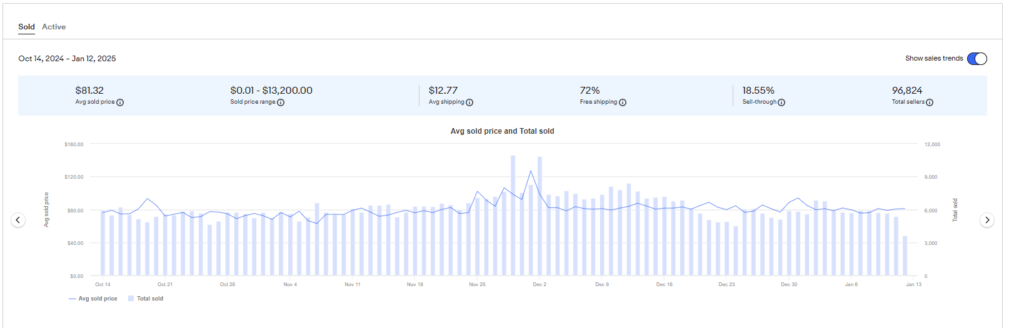

Next, we can look at the average sold price in relation to the total sold. I really like this data because it can tell us if lower prices drive more sales. In the case of headphones, the answer is no, and here’s why.

The average sold price is $81.32.

If look across the average sold price data, there are some days when the price drops below the $81 average, but the sales don’t increase. In some cases, a drop in price was followed with a slowing of sales.

As we drill in further, we will start to see some more clear indicators of the relationship between price and sales action.

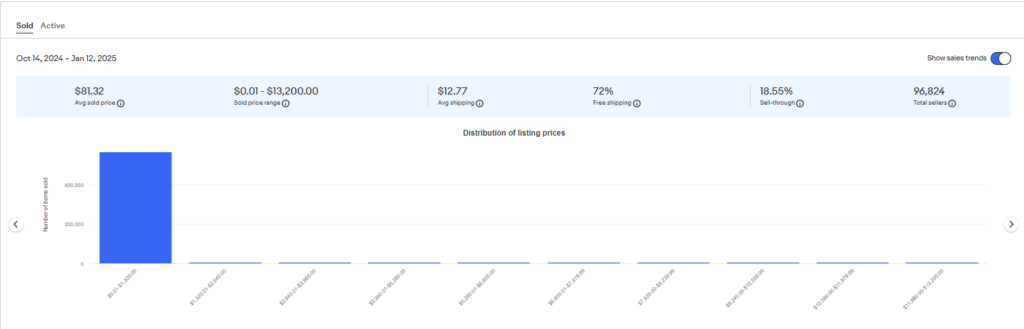

We can also view the distribution of listing prices. What this tells us is that 99% of all headphones are going to list for less than $1,000. No real surprises there, but there may be some interesting opportunities in the high-end or rare headphone market for buying and selling above the $1,000 price point.

The last data set we’re looking at is market share, which is super helpful for understanding how competitive the market is. For example, with headphones, 10% of sellers account for 60% of the sales. That means 6 out of 10 headphones are sold by just a handful of big players. While this might seem intimidating at first, don’t let it discourage you—it’s actually a great opportunity to learn more about the competition.

Are these big sellers manufacturers? Do they sell a wide range of electronics, or are they focused only on headphones? Knowing who you’re up against can help you create a smart business strategy.

For example, if most of the big sellers are general electronics retailers, you could stand out by becoming a true expert in headphones. Learn the technical specs, key features, popular colors, and everything else customers care about. That way, you can offer amazing customer service and advice, which is something large competitors might struggle to do because they’re juggling so many products.

Your ability to focus and specialize is a huge advantage that can help you compete in this category, even against the big players.

Step #4 Drill Deeper into (product level behavior) using listing filters

Now that we have a solid understanding of the overall activity in the headphones market, we can start digging a little deeper. To do this, we’ll use the filters we explored earlier in the listing results. These filters are super helpful because they highlight the key features customers care about when shopping for headphones.

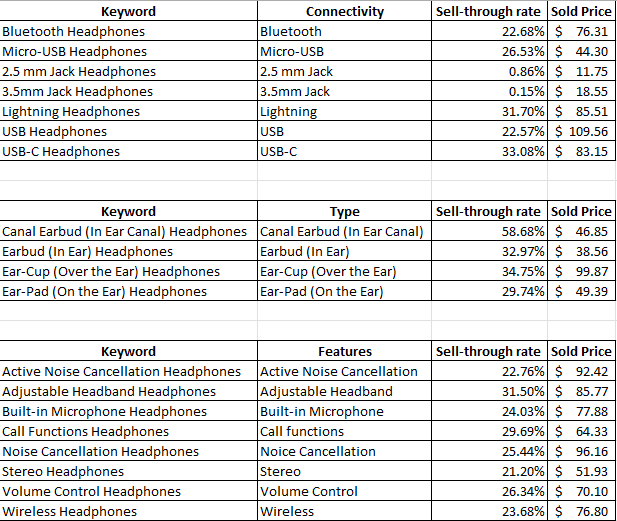

From here, it’s all about researching each feature to find the ones with the highest sell-through rates. This will show us which features customers value the most. Let’s start with one of the first features in the filters: Connectivity Types.

There are a few different options, so to make things easier, I’ll organize this information into a table. This way, we can clearly see which connectivity types lead to the best sell-through rates.

In the table, I’ll list each connectivity types and features from the filters along with the specific keywords used for them. Then, I’ll plug those keywords into Terapeak to pull the sell-through rate and average sold price for each option. This will give us a clearer picture of what’s driving sales. Let’s take a look!

After working through each of the connectivity types and features, your data table should look similar to this one.

Now we’ve got enough information to spot what’s really popular in the market. Customers are clearly looking for features like Bluetooth and USB-C connectivity. They also love in-ear canal headphones, especially ones with call functionality, volume controls, and noise cancellation.

The best part? All this data comes straight from eBay’s listings and product research tool, giving us a treasure trove of valuable, long-tail keywords. With these, we can create optimized product listings and confidently source products that we know are in high demand. It’s like having a cheat sheet for success!

Let Customer Data Guide Your Strategy

So, we’ve gathered all this great data on customer behavior—now what? How do we put it to work? Well, that depends on how you source your items.

If garage sales are your go-to for finding products, now you have a clear idea of which items in your category will sell well. If you’re into retail arbitrage, this data tells you which products to scan first. If you buy wholesale pallets, you’ll know exactly what kinds of headphones to watch for on the manifest. And if you white label products, this info helps you figure out what to source on platforms like Alibaba or Global Sources.

In the world of online selling, data is everything. It’s your secret weapon for staying ahead of the game. The more you can access and use it to make smart decisions, the better your chances of long-term success and growth.

Make product research a regular part of your routine—doing it about four times a year is a great habit. With this approach, you’ll become a true market expert and set yourself up for success!